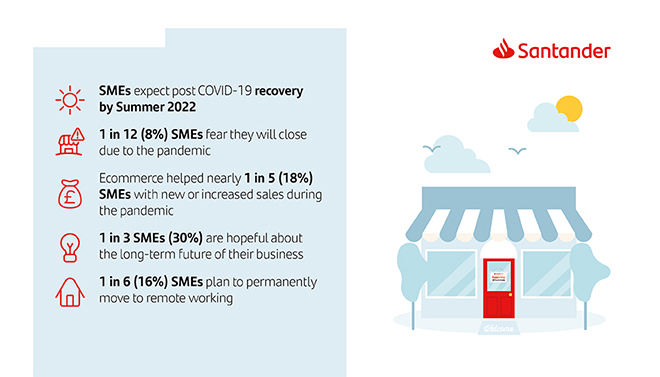

SMALL and medium-sized businesses that have suffered due to Covid-19 do not expect to recover to pre-pandemic levels until summer 2022, according to new research published by Santander UK.

With the UK now well into a vaccination programme that many hope will enable the economy to start reopening, ongoing cashflow issues and a decline in consumer demand means that one in 12 small businesses do not expect to survive the pandemic.

The research also found that 21% of UK SMEs say they are “not sure” if they will survive long enough to take advantage of any change in the current restrictions.

The data reveals that Covid-19 is likely to widen regional disparity, with London firms forecasting a decrease of 3.8% in profits by March 2021, compared to before the pandemic. For the East Midlands, the figure is an expected decrease of 11.6%, 9.3% in the West Midlands and -7.1% in the North West.

Mental health issues are a growing concern for small business owners. Two-fifths (of women running small businesses reported a decline in their mental health since the Covid-19 outbreak, compared to 26% of their male counterparts.

Women were also less likely to seek support when it came to maintaining mental wellbeing, with 41% stating they would not ask for help – 5% more than that of male business owners (36%).

Susan Davies, head of business banking at Santander UK, said: “Small businesses have proven their resilience so far and their hunger to survive and thrive is palpable. With the growth of remote working, small businesses across the country will be at the forefront of our economic revival but 2021 will be a crunch year for many, with a lot riding on a successful vaccine rollout.”

There is no ‘silver bullet’ solution but extensions of VAT deferrals, the furlough scheme and business rates relief may provide extra breathing space, she added.

“We have been working tirelessly to support small business owners throughout the pandemic – from online workshops, ecommerce training and mental health support – and we will continue to help them find solutions to the huge challenges they are currently facing.”

Only 42% of small businesses report that they have not had to halt any part of their operations since the outbreak of the pandemic, with respondents seeing their profits slump by 16.5% on average.

SMEs run by people from ethnic minority backgrounds experienced the most significant decline in business activity, with almost half (47%) seeing a dip since the Covid-19 outbreak. According to the data, 67% of businesses run by ethnic minorities were operating “well” at the start of last year, compared to just 20% when the pandemic hit. In non-ethnic minority-run businesses, respondents experienced a decline in performance from 58% to 25%.

Almost one in five SMEs have started or increased sales through online platforms as a result of the pandemic, although 63% stated that selling their product or services online or through social media was not an option.

The disparity makes clear that there are a significant number of businesses that are simply unable to generate revenue, says Santander, reiterating the importance of additional support through government lending schemes and tax reliefs.

The report reflects fears for the future of the high street, as 29% of small businesses are set to leave city centre hubs this year. Almost one in five (18%) SMEs currently located on the high street say they plan to relocate, while a further 11% say it is likely that they will have to permanently close their business.

Santander UK has delivered £4 billion of financial support through the government-backed Bounce Back Loans to SMEs since the scheme’s launch. The bank has also harnessed its business insight and sector experts in order to provide non-financial support across the UK.

Its Survive and Revive business support programme includes initiatives such as webinars and mentoring, free advertising on Santander Marketplace and toolkits. For more information about Santander’s Survive and Revive programme, click here.

…………